We found the following post on Facebook:

The post, on the page “SG Opposition” which has 57.3k members at the time of writing claims that 50% of Singaporeans do not pay income tax, attributing the statement to Member of Parliament (MP) Poh Li San. The post has drawn considerable attention, with many readers reacting with surprise or indignation at what appears to be a revelation about tax inequality in Singapore.

When we investigated the claim, we found the source of the quote- a PAP rally held at Woodlands Sports Centre on Apr. 24. In response to a proposal by SDP to lower GST, Ms Poh claimed that 50% of Singaporeans do not pay income tax. If GST is reduced to 5% then, all residents would have to pay income tax as an alternative form of revenue.

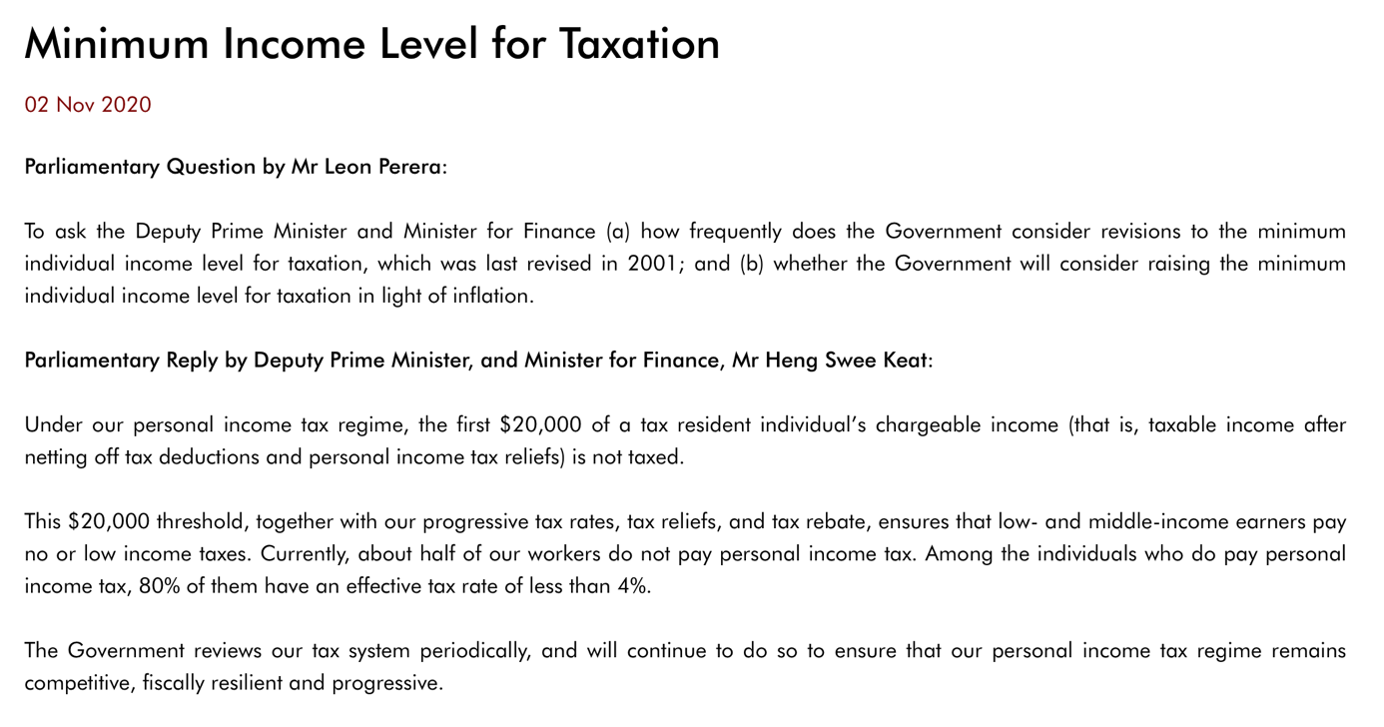

According to a parliamentary reply from 2020, approximately 50% of Singapore’s working residents are not liable to pay personal income tax. This is primarily due to Singapore’s progressive tax structure and a relatively high personal income tax exemption threshold. Under current tax rules, the first $20,000 of chargeable income is exempt from income tax. This means that individuals earning below this threshold are not taxed.

Moreover, Singaporeans are entitled to a wide array of personal income tax reliefs and deductions – including CPF relief, NSman relief, and various family support deductions – which can significantly reduce or even eliminate tax liability. As a result, even those earning slightly above $20,000 may not end up paying any income tax after reliefs are applied.

While the claim is technically correct, it omits critical context. First, the statistic applies specifically to personal income tax, not taxation in general. It would be incorrect to interpret this as meaning that half of Singaporeans do not contribute taxes for national development.

In reality, Singaporeans pay a range of indirect taxes, the most prominent being the Goods and Services Tax (GST), which applies to most purchases regardless of income level. Other taxes – such as property tax, vehicle-related taxes (COE, road tax), excise duties (on alcohol, tobacco, and petrol), and stamp duties – are also paid by residents across all income levels. Therefore, while some Singaporeans do not contribute via personal income tax, they nonetheless contribute to state revenue in other significant ways.

The claim that 50% of Singaporeans do not pay income tax is statistically accurate and was indeed made by MP Poh Li San. However, the presentation of this fact in isolation – particularly on a platform that invites partisan interpretation – is misleading. Without context, it may give the impression that half the population does not contribute to public finances, which is far from true.