In 2023, a study by Visa showed that card payments overtook cash usage in Singapore – with contactless transactions in particular rising steadily. This has continued to be the case in 2024, with recent research showing that 76% of Singaporeans use credit or debit cards for payments. Even as long-standing traditions involving cash (such as red packets during Chinese New Year or weddings) have endured, the trajectory of digital payments suggest that cash will continue to play a lesser role in the daily transaction habits of Singaporeans.

Within this landscape, what does it mean to be “cashless” or a “cashless society”? How do Singaporeans feel about the reduced usage of cash – and what does cash (both the physical notes and literal action of paying with cash) mean to them? Has this shift had a positive or negative impact on their lives and transaction experience? Do Singaporeans have concerns or anxieties involving digital payments, and how do they perceive their own use of digital transactions now and in the future?

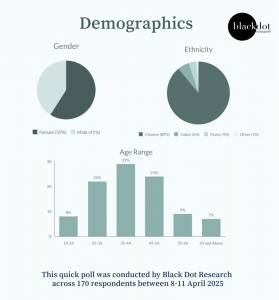

Black Dot Research polled 170 respondents in a quick survey to gather perspectives from across Singapore.

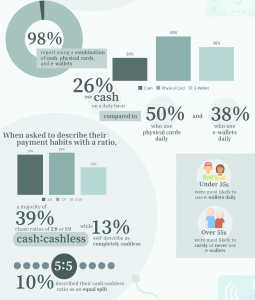

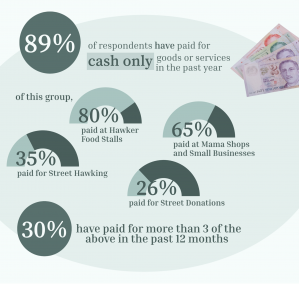

While respondents generally demonstrate an expectation that a cashless future is imminent, current usage nevertheless reflects a mix of different payment methods. For instance, a majority have used cash-only goods and services – primarily Hawkers (80%) and Small Businesses (65%) – in the past year.

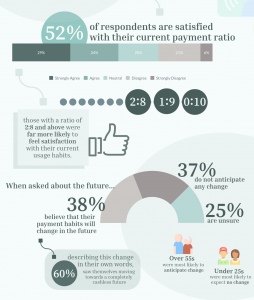

Age segmentations reflect a difference in opinion between those under-25 and those over-55 – with the former being more likely to embrace e-wallets and other cashless payment methods, and the latter being less likely to utilise them. Those over-55 were much more likely to anticipate having to shift their payment habits in the future compared to the group under-25. Those aged 35-55 were more likely to be “neutral” on whether cashless payments are more secure than cash payments. And, those specifically in the 25-35 range were most likely to be worried about the safety of e-wallets and digital payments compared to the under-25s and over-45s.

Sentiments about the move to a completely cashless society, however, reflect mixed feelings across respondents. Although a majority do indicate a personal preference for cashless payment methods, a significant portion (77%) still believe that cash payments should remain available as an option. When asked specifically about their Singapore as a cashless society, a small majority (46%) feel it is a positive shift – while a smaller section (24%) occupied the opposite position.

Across the board, respondents displayed a fairly high degree of ambivalence about their payment habits and the role of payment methods such as cash. Many were neutral or without strong opinions about physical cash (being part of Singapore culture) or about Singapore’s cashless shift and potential security risks.

Further questions could seek to examine this ambivalence, as well as explore more specific topics such as the role of online marketplaces, the use of cash for ceremonial functions (such as red packets), and where online investments (such as cryptocurrency) fit into the landscape. More might also be asked about Singaporean’s experiences with digital scams or security breaches involving e-wallets.